Safetica’s aim has always been to create a world in which organizations, no matter how large or small, don’t have to worry about data loss. A world where the burden of protecting sensitive information against constantly evolving threats is lifted and shifted onto a trustworthy and competent partner. One of the most vulnerable industries in the data protection realm is financial services. In the financial industry, the estimated average cost of a data breach (based on IBM's Cost of a Data Breach Report 2022) was $5.97 million – the second highest only after the healthcare industry. That’s not a small amount!

Why is it that financial institutions have to pay special attention to their information protection management systems, and why do we think Safetica should be your partner in doing so?

1. Data security and data loss prevention

Financial institutions have access to a bottomless treasure chest of highly sensitive information – credit card numbers, social security numbers, dates of birth, email addresses, and phone numbers. If that information gets lost or stolen, it can cause all sorts of trouble – from lawsuits and loss of client trust to dire financial consequences. Not to mention the huge headache of recovering after data loss, which is not something every organization is capable of.

Putting into place processes and systems to keep data safe is probably one of the first things a financial institution does, but getting it right isn’t easy. There’s just so much to think about!

When cracks in the system start to show, it’s usually too late to try to fix them without some data loss. Data security needs to be as fail-proof as possible from the very beginning.

The most common causes of data loss:

- Natural disasters

- Human error

- Hardware failure

- Corruption or loss during data migration

- Data breaches (cyber threats)

To be absolutely certain that an organization is doing everything it can to protect the data it has been trusted with, there’s such a wide spectrum of variables to take into consideration that, without the help of an expert, it can easily become overwhelming.

Data loss prevention (DLP) solutions can prevent accidents from happening but also track unwanted data loss or theft if it does happen (because not everything can be predicted), report on it, and can improve existing policies to make sure the same mistake doesn’t happen in the future.

![]()

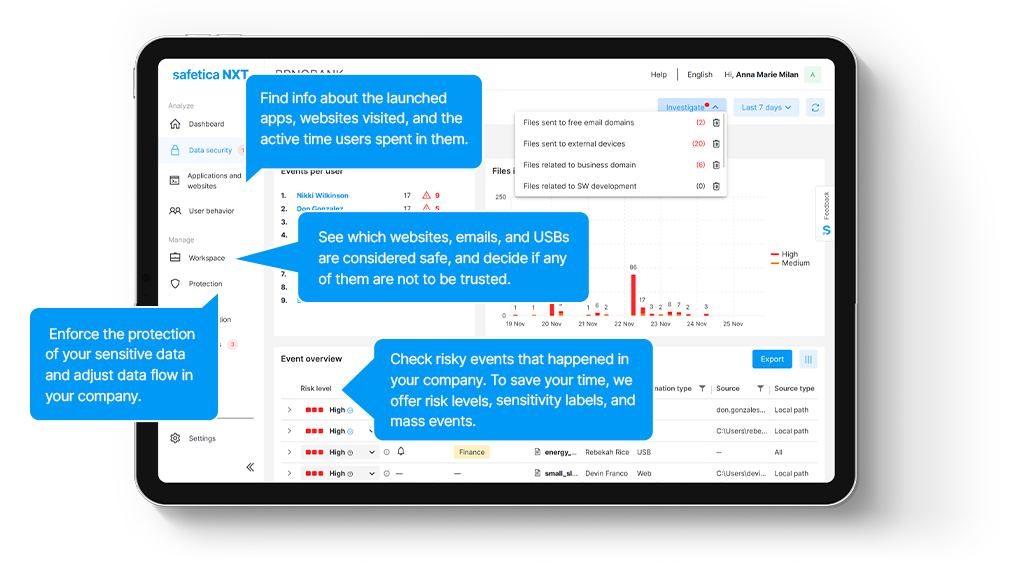

Safetica offers two data loss prevention solutions: the Next-gen SaaS DLP, which covers key data security scenarios, and our Enterprise-grade on-prem DLP, which offers all-in-one data loss prevention and insider threat protection.

2. Data breaches and ISMS

When we talk about a data breach, it means a security violation during which an unauthorized individual (or group) somehow gets their hands on an organization’s sensitive data, either for personal use or, usually, with the intent of malice. That could mean the data is viewed, copied, or otherwise stolen, sometimes with the help – intentional or unintentional – of someone from within the affected organization.

According to the ITRC's yearly report on data breaches, 92% of data compromising incidents in the first quarter of 2022 were a result of some form of cyber-attack, and based on the Verizon Data Breach report, the cause of 82% of all data breaches in 2021 were human errors.

Something as easy as logging into the organization’s system from an unprotected network during remote work, getting that laptop stolen, falling for a phishing email, or just not being careful enough with access information can be just the opportunity a cyber attacker has been waiting for.

And so, it is obvious that protecting an organization’s sensitive information from data breaches isn’t just about having a stellar IT system, it’s much more than that.

No firewall or program is going to protect an organization from the biggest threat out there – humans. Humans are clever, but they make mistakes, which is like a double-sided sword that can harm any financial institution.

Every organization, not just in the financial industry, needs to put into practice a well-thought-out information security management system (ISMS) that includes policies, procedures, technical measures, and staff training, to mention a few. All this is to protect against not only cyber-attacking humans but also those who make mistakes (aka all humans).

There are frameworks an organization can use to assist with creating and maintaining their ISMS. For example, ISO 27001 is a methodology that aims to create and implement an effective ISMS. Not an easy task without professional help – it’s not step-by-step instructions that you follow while setting up an ISMS, it’s an all-encompassing guide within each organization that will need to find what is and isn’t applicable to them.

![]()

Safetica can help you comply with ISO 27001 through security audits, data classification, setting up policies to protect sensitive data, or managing company assets.

3. Regulatory compliance

Speaking of rules and procedures, it’s not just the steps a financial institution chooses to take to protect data, some policies are set out in regulatory documents and mandatory security standards.

For example, the Payment Card Industry Data Security Standard (PCI DSS, or PCI for short) applies globally to all entities that process, transmit or store cardholder data, no matter the size or number of transactions. That means that in the financial industry, it applies to everyone.

There are 4 levels of compliance with the PCI DSS, and each level will have different requirements for PCI validation and reporting – the larger the organization, the more burdensome the requirements.

It isn’t, however, a one-size-fits-all situation or a simple list to tick off and be done with. Many financial organizations find it challenging to meet the security requirements of PCI DSS. Even more so when they realize this isn’t a one-time hurdle but a continuous effort.

Failing to comply with this and other regulations can result in fines, audits, and of course, data breaches and all that those entail.

![]()

Safetica can create and implement well-defined, aligned, and up-to-date information security policies. We can provide an overview of information flows and sensitive data storage, automatically classify PHI data, and manage storage encryption across the entire organization, among other ways to help with regulation compliance.

4. User-friendly solutions

In the vast and intertwined world of data loss prevention, Safetica’s DLP systems and professional compliance services will feel like a sigh of relief. We strive to bring sense and clarity into data protection, so first and foremost, Safetica’s solutions are easy to understand, easy to integrate, and cost-effective. And we’re proud of that.

For example, our Next-gen SaaS Safetica NXT solutions come with built-in templates and automation that IT admins can handle within their current capacities, so there’s no extra hassle for employees. For all-in-one data prevention Safetica ONE, we provide the easiest to implement & integrate on-prem enterprise DLP, 3rd party integrations, and regulatory compliance support.

We believe that security should never be at the expense of productivity, no matter how complex your organization’s ecosystem is. We make sure to work with organizations in a way that takes the stress away, not piles it on.

But don’t trust our word for it. See what our customers say

Next articles

The Age of Data: Why Cloud Growth Raises New Security and Ethics Risks

As cloud adoption surges, security and ethics struggle to keep up. Safetica’s CTO shares how organizations can manage risks in the era of data at scale.